how to calculate pre tax benefits

Benefits of Pre-tax Deductions. Additionally since they are not mandatory the decrease of.

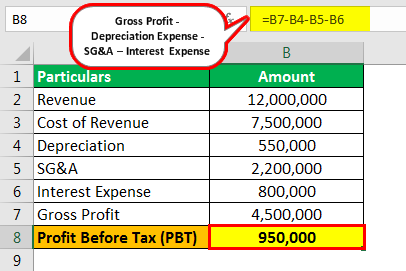

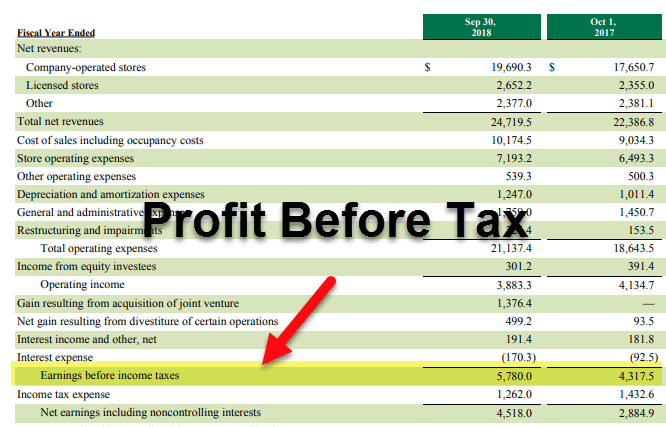

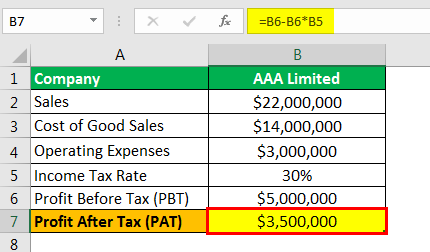

Profit Before Tax Formula Examples How To Calculate Pbt

When you begin payroll withholdings you will first withhold the 401 k contribution because it is pre-tax.

. Kritika has taken a loan. Not Only Get Your Refund But Many Other Answers. If pretax deductions are not included in taxable wages subtract the benefit from gross wages before calculating state or local income tax according to the agencys criteria.

A pre-tax benefit plan is an account which you sign up for through your employer and fund through payroll deductions. In most cases deduct the employee-paid portion of the. Please note this calculator can only estimate your state and.

Social Security tax is also called Federal Insurance Contributions Act tax because the FICA mandates its collection. How to calculate pre-tax health insurance. Ad Use one of the 10 Online Tax Calculators.

Subtract the value of your debt service from your NOI. Say you have an employee with a pre-tax deduction. In order to understand the implications of tax benefits on Pre-EMIs paid towards a loan check out the example mentioned below.

Pay Period How frequently you are paid by your employer. Taxes Made Simple Again. Identify applicable payroll taxes.

Peter contributes 5 005 per pay period to a pre-tax 401 k plan. Taxes Are Complicated Enough. As a result this lowers the total.

How are these numbers calculated. Adjust gross pay by withholding pre-tax contributions to health insurance 401k retirement plans and other voluntary benefits. This permalink creates a unique url for this online calculator with your saved information.

Follow these steps the next time you do payroll. Some facts about Saras pretax deductions. A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover.

The deduction is 50 per payroll and you pay the employee a gross pay of 1000 per biweekly pay period. For example if you make 12 payments of 1400 over the course of the year that adds up to a debt service of 16800. It is a written plan that allows your employees to choose between.

We take your gross pay minus 4050 per allowance times this percentage to calculate your estimated state and local taxes. A cafeteria plan including an FSA provides participants an opportunity to receive qualified benefits on a pre-tax basis. Ad Calculate your tax refund and file your federal taxes for free.

Please come back later. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

The money is pulled from your paycheck before taxes. The savings from pre-tax deductions depends entirely on how many pre-tax benefits are elected and the amount an employee decides to contribute to them. Identify potential pretax deductions.

Employer-sponsored plans are typically pre-tax deductions for employees. Preparing Them Shouldnt Be. Pre-EMI tax benefit case study.

Annual Gross Salary Total annual salary before any deductions. See What Credits and Deductions Apply to You. Cannot load calculator at this time.

Enter Your Tax Information. Pretax deductions are employer-sponsored benefits that meet the. In short with pre-tax benefits the benefit cost is deducted from an employees paycheck before income and employment taxes are applied.

Refer to the employees Form W-4 and the IRS tax tables for that. First and of utmost importance is that before-tax deductions in fact reduce taxes.

Profit Before Tax Formula Examples How To Calculate Pbt

How To Calculate Payroll Taxes Payroll Taxes Payroll Bookkeeping Business

Profit Before Tax Formula Examples How To Calculate Pbt

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

Profit Before Tax Formula Examples How To Calculate Pbt

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

Understanding Your Solar Panel Payback Period Energysage Solar News Feed Payback Solar Solar Quotes